By Rachel Garrett, IHCA Director of Community Operations

(Originally published in March 2015 Connections News)

The Issaquah Highlands Community Association (IHCA) Finance Committee has been preparing the IHCA 2015-16 budget for IHCA Board of Directors approval and community ratification.

Finance Committee members are appointed by the IHCA BOD and work with the IHCA staff to develop a budget recommendation to the BOD, using their financial expertise, knowledge of community and legal requirements, and a commitment to maintaining the communitywide standards.

Current Finance Committee members include:

- David Ngai, IHCA BOD treasurer

- Walt Bailey, IHCA BOD member

- Alex Garrard, resident member

- Cecily McDonald, resident member

- Jane Gu, resident member

- Melody Greene, resident member

The budget is first developed by the Finance Committee, with staff support, and presented with recommendations for approval to the IHCA Board of Directors. After the board approves it, a membership meeting is required to ratify the budget. In accordance with state law and the IHCA Covenants, Conditions & Restrictions (CC&Rs), ratification is automatic unless 75 percent of all members (not just those in attendance) vote to reject the budget.

There are many factors that the Finance Committee must consider when developing the community budget. These driving factors include:

- Protecting the integrity of the investment of every homeowner within Issaquah Highlands.

- Maintaining the standard of care and safety of community property and common areas.

- Ensuring efficient planning for future community needs.

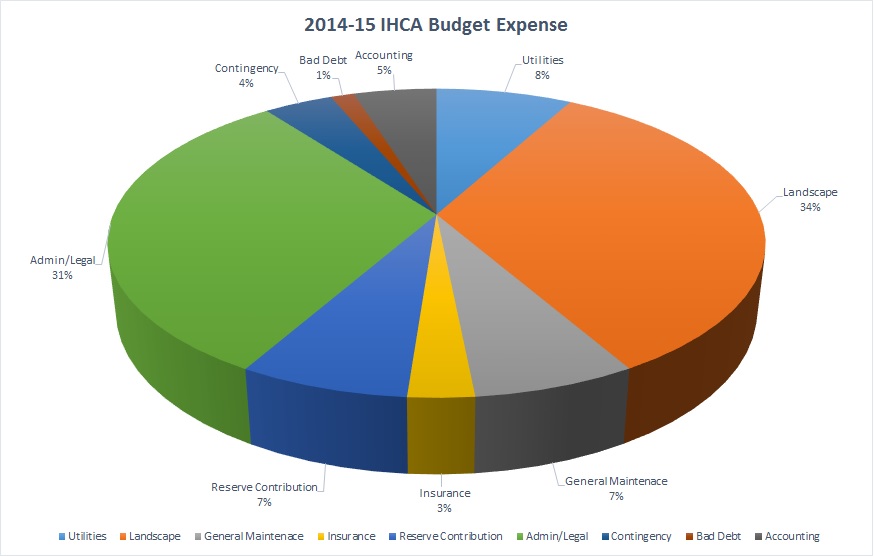

The Finance Committee reviews the funds needed for daily operation of the community, such as common electricity and water, grounds maintenance, management, insurance and general maintenance. These expenses are either contractual or can be reasonably estimated based on experience. The Finance Committee also reviews the income needed to maintain the reserve fund at sufficient levels. Reserve funds provide money for the repair and replacement of the community’s assets — such as playground equipment, drainage infrastructure and irrigation equipment.

Armed with this knowledge, the committee will estimate total expenses for the coming year and compare that sum to the association’s potential revenue (assessments, interest on investments and shared costs revenue). The committee will look for ways to lower expenses without compromising service and address areas where operating efficiencies may be realized.

The annual budget must also meet the legal requirements of operating a nonprofit association and address any economical and operational challenges that may lie ahead.

QUESTIONS ABOUT THE BUDGET

Why do I pay assessments?

Issaquah Highlands is a master planned community also referred to as a Common Interest Community. Common Interest Communities — including homeowners associations and condominiums — are home to more than one in five Americans. When you purchased your home in Issaquah Highlands, you agreed to be part of the association. Association members assess themselves for the upkeep of their community and their services and amenities. Because of resident-supported amenities and rules to protect property values, homes in community associations are generally worth more than similar properties that are not located in an association.

How are base assessments calculated?

As required in the CC&Rs, base assessments are calculated by taking the total budgeted expense and dividing this sum equally between all homeowner and builder-owned lots.

Association budgets must zero out after expense and reserve contributions, with any shortfall either carried over to the following year’s annual budget or recouped through a special assessment.

Who pays for empty lots?

Builders pay full share per empty parcel or lot.

How can I help to keep costs down?

- Clean up after yourself. Debris left in the common areas, especially pet waste, requires special maintenance and can mean additional costs.

- Be kind to the landscaping. Every bush destroyed or flower trampled has as price tag attached, and so does the labor to replace it.

- Observe the rules. Association rules are not arbitrary or frivolous. They have been carefully developed to maintain property values and keep insurance rates down.

- Make your assessment payments on time. Every delinquent account requires staff time and eventual legal counsel to pursue collections.

Why do we need a Reserve Fund?

Equipment and major components must be replaced from time to time, regardless of how well we plan for these expenses. Reserve funds are not an extra expense — they just spread out expenses more evenly. There are other important reasons we put association monies into reserves every month:

- Reserve funds provide for major repairs and replacements that we know will be necessary at some point in time.

- Reserve funds meet legal, fiduciary and professional requirements.

- Reserve funds minimize the need for special assessments or borrowing.

- Reserve funds enhance resale values.

Do I have a say in the budget?

Yes, every homeowner has a say. The Finance Committee is a subcommittee of residents appointed by the IHCA Board of Directors. Every homeowner is encouraged to participate in the ratification process.

Who pays for IH parks and streetscape?

The IHCA pays for maintenance and irrigation of common areas with parks and streetscape through our homeowner assessments and contributions from shared costs agreements.

Are IHCA financial records audited?

Yes, IHCA books are audited on an annual basis. Completed audits are posted on www.ihwebsite.com as they become available.

A follow-up article is coming in April Connections with more details.

The IHCA Board of Directors meets every fourth Wednesday, 5:30pm at 1011 NE High Street, Ste 210